Interesting Stories From Early Retirement

When I started my retirement, I was unaware of many things that will happen in the future. No one can anticipate what life throws at you. No matter how much you plan you cannot be prepared for some things. There have been many such moments in the past 7 years of our retired life. I thought I should pick some of those events and explain what I felt and how I handled it.

What is one of the most scariest thing in retirement, especially early retirement? It is the fear that you may not have enough money to live through your full life. Early retirement is especially tough on getting the numbers right because you are assuming several things about your finances and expenses. That is how you decide to retire early. It becomes risky if you have made calculations that is just about enough, say using the 4% safe withdrawal rate (SWR) and decide to retire early.

Now what could go wrong? Well, sequence of returns. In the initial years of retirement, if the returns from your corpus are below your expectations, then you will have a bad time in future. Say for example, your annual expenses are Rs. 8L and so you retire with Rs. 2 crores (4% SWR). Then you assume a 10% return on investment. What will happen if in the initial years your returns were less than 10%?

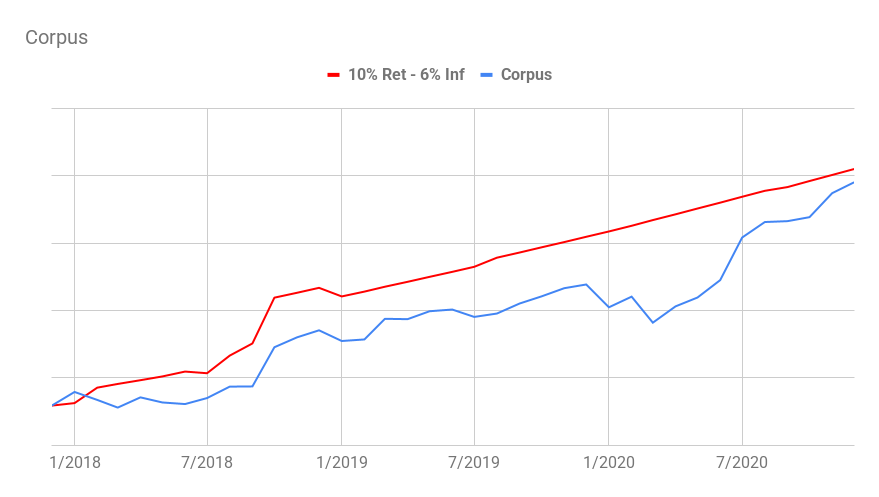

That is precisely what happened to me. I mean the poor returns in the initial years, not the numbers. I ended 2018 with my corpus returning just 4% instead of my expected 10% returns! Generally, you expect some bad years in the stock market, so it should not be a cause for concern. The next year (2019) gave me 9% returns which is almost on par with the 10% returns I expected. Finally, 2020 returns were amazing with 15% returns.

Yet, even with those stellar returns in 2020, my corpus was still below projection for all those 3 years. That is what one bad sequence of returns can do to your investments. Just one bad year in your early retirement takes more than 3 years to recover.

How do your counteract such unfortunate unexpected events? Have a lower safe withdrawal rate, say 3% instead of 4% or alternatively include a buffer say 20% more than what 4% SWR would suggest. I did the latter and that is how I was able to navigate the situation stress free. What is the disadvantage of either of these approaches? You have to delay your retirement date.

Although 2020 has been a good year for returns, there were several low lights. For one, the world was hit by COVID-19 and many families’s lives were disrupted. Loss of life, health problems, work from home and online school life etc, became the norm. So many things have changed with just one event.

Personally I had other problems, including a big portion of my investment getting locked in Franklin mutual funds and a bunch of electronics blowing up. Eventually the mutual fund returned back the investment but I had to pay a huge sum in taxes. You can read about the rest of the low lights in one of my posts.

While I ended 2020 with good returns, it was not how it was during the year. At some point, the Sensex dropped by 30%. Going through so many negative events soon after retirement is not an easy task. But we were in good spirits all through.

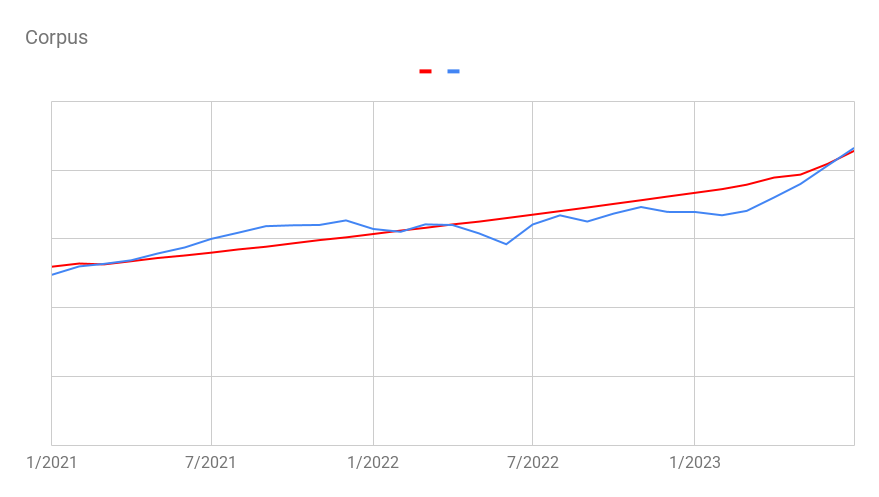

As time passed, the situation improved a bit. For the next 2.5 years, the returns were a nominal 10% as I hoped it would be in retirement. With that kind of returns, the corpus was very closely following the projection for those 2.5 years.

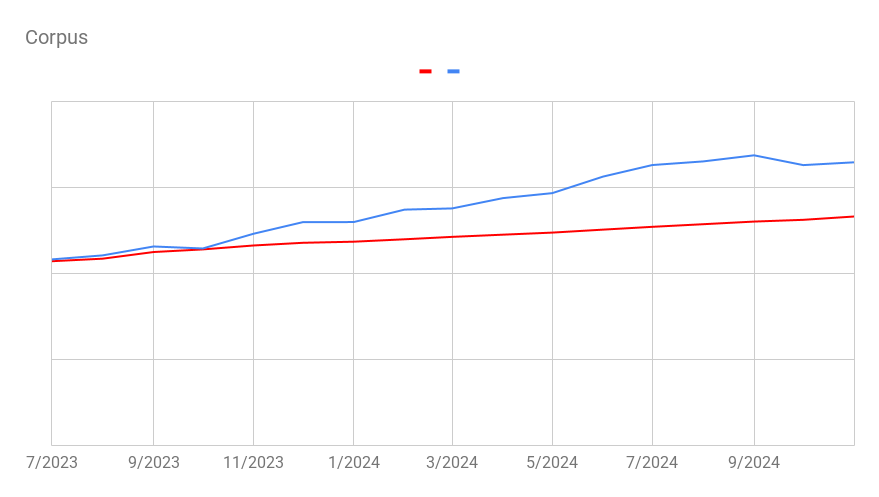

Then returns improved further in the next 1.5 years and as a result, for the first time in almost 6 years after retirement, the corpus has been decisively above projection for a full year.

Will these favorable results continue on into the rest of my retired life? I doubt so. I am known to be an eternal pessimist, so I think the coming years will not be as rosy as the last couple of years. But overall, whether the going was good or tough, we have survived through all of them with the same composure and equanimity.

We have to hope for the best things to happen but always be prepared for the worst. Preparation for the worst is what I have always been good at. We will have to wait and see what the future holds :).

Other than the financial aspects, there were a lot of interesting stories from our life in which we see the funny side of things. There are hundreds of such stories, but we don’t remember many. Here are just a few interesting ones that we could recollect. Many people either feel, proud or jealous or curious or some other feeling towards us when we mention that we retired early and do nothing. But the curious ones are the funniest.

So this one time a couple who we barely knew came to our house and through some conversations, they found out that we retired. Normally, most people ask how we planned for retirement, how we saved, where we invested etc. These are just the usual questions that we are used to. But the lady was interested in only one thing – how much did we save up. Her exact question was more like – “So you saved up so much that you don’t have to work? How much did you save? What is that number”. Now this is a very private question even if it was coming from a close friend. But we barely know these guys.

Another time, an acquaintance of my wife visited us. In our house we have an android tablet in the living room which I programmed to show our pictures. As the pictures were changing, she happened come across a photo where my wife and kid were in some foreign country. Then the lady looks at the my wife and says – “Oh so you have been to foreign countries? Then why you dress like this?”. The “dress like this” was with a tone of “why do you look like poor people”. Well, we are minimalists. So most of the times, when we are in the house we wear old faded clothes. Sometimes with small holes in them (due to several washes over the years). Some of the clothes we wear are from 15 years ago. So I can’t blame her when she thought we are probably poor folks based on the dresses we wear. That was one more funny incident in retirement.

The most common and usual question we get asked is – “Don’t you get bored of sitting at home all day after retirement?”. But there is one person who we know well for more than 15 years who keeps on asking the same question almost every single time we meet him. No matter how many times I explained that I do this and that (hobby projects, home schooling, workout etc), he still comes back to the same question the next time I meet him. No, he does not have dementia, he just can’t get himself to believe that we cannot get bored even after 7 years in retirement.

Oh and there was this hilarious comment that was passed one time. So a friend of mine came with his brother to visit us. This is a very old friend but we rarely met and I’ve never met his brother. In the due course of a conversation over tea and snacks, my friend mentions to his brother that I retired early. The brother’s next question was – “What do you do all day? Just cook and wash dishes everyday?”. And I was like laughing to myself uncontrollably, at that comment. I didn’t say anything much. Just smiled back and gave my usual reply of hobby projects etc. But it is funny to think about the range of emotions that early retirement stirs in the hearts of many people.

Anyway, I thought I should end the post on a light hearted note instead of drab financial information and sad stories from my retired life :). Many people I know are more interested in our personal life or our financials or how much we saved up or how we paid for our farm etc rather than learning how to invest or how I achieved financial freedom. I think I live in a world that is different from theirs.

Cheers!