Is The Stock Market Peaking?

I am a little bit concerned. The stock market has been giving great returns for the past 3 years or so. Since the COVID-19 pandemic there has never been a long drawn bear market scenario. How long can this continue? On top of it, I see more and more people getting involved in trading. Some are even quitting their jobs to do trading full time. Generally, when there is euphoria in the market, you see these kind of events happening. New traders, who think they are investors and think they have the know how, enter the stock market just as the market starts peaking. Then, armed with a bunch of algorithms based on back testing, start to do algo trading. When you see more and more of these people, you know the time has come for the market to crash.

But of course it does not always happen. That is the twist in the story. Now, I don’t know if the current market is ripe for a crash. Nor can anyone predict. However, a recent trend that I started noticing is that more people are getting involved in stock markets. I think the FOMO has caught up with them. They see their friends and family making good money in the stock market and wondering why they aren’t also doing the same and make a quick buck. Typically, when the herd starts to get tempted to make quick money in the market seeing the recent past’s results, the riskier it becomes.

I have been recently talking to friends who all of a sudden are talking about algo-trading. These guys have not breathed a word about stock markets. Then I hear stories about some friend of friend quitting job to do trading full time. Another red flag. Since many of my friends already know that I don’t support trading, they don’t ask me about the market. But I can feel their excitement. I started to wonder if the markets are too high.

I took a look at all the indices that I follow and to me it seems like Nifty 50 and Nifty Next 50 while higher than average are not too expensive. I can’t say the same about Nifty Midcap 150 and Nifty Smallcap 250 indices though. Lets take a look at some Nifty 50 signals starting with price-to-earnings ratio.

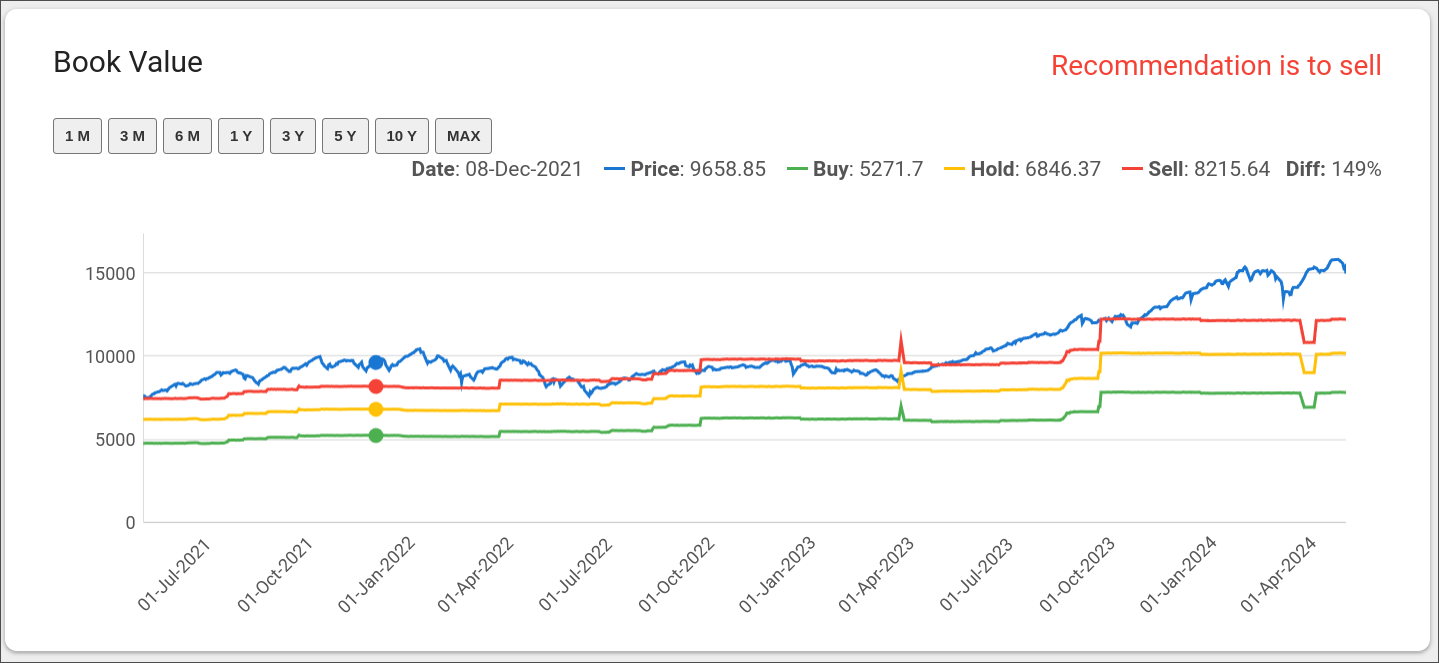

You will notice that the price (blue line) is above the yellow line but below the red line. Which means, according to my crude calculations, Nifty 50 is not expensive enough to sell and move to fixed income, but it is expensive enough to the point that I would not sell from fixed income and invest in Nifty 50. The price to earning is just one signal. How about price to book value?

The recommendation still remains the same. There is nothing to be excited about in either direction. Neither does it indicate that I need to sell nor does it indicate a buy opportunity. Next we will look at the volatility index (aka VIX).

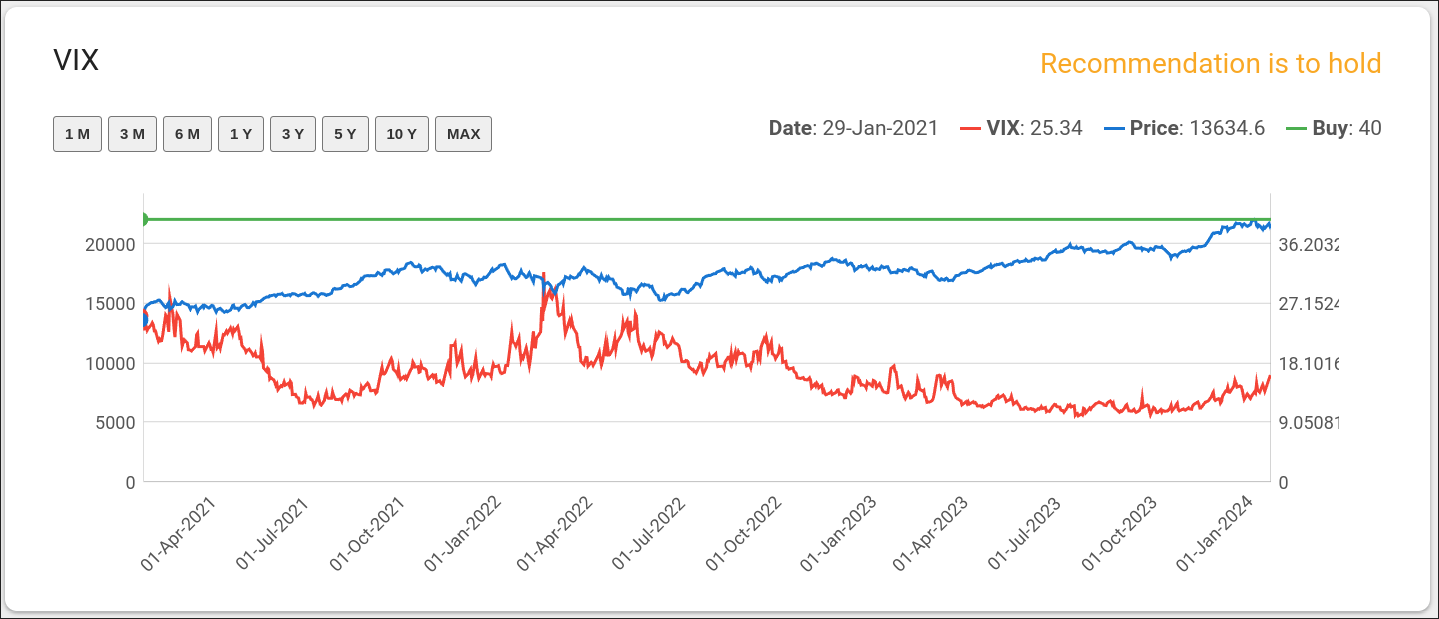

The volatility index is at near the lowest. There hasn’t been any crazy buys and sells. So again, there is nothing to worry, but neither is it a great time to invest. How about Nifty 50 price to GDP?

The price is closely following the GDP line but is staying below it. So it is not expensive. At the same time it is not so far below the GDP line to suggest any investment opportunity according to my signals. However, with Nifty Smallcap 250, the results are quite different. All the signals seem to indicate that the market is expensive and it would do me well to sell.

Well, economists have successfully predicted nine of the last five recessions. So yeah what do I know and I am not an economist either. But seeing so many people starting to trade all of a sudden got me thinking. At least my barber is not yet giving stock tips, so perhaps it is not as bad. Like they say – when a barber offers you stock advice, then markets are overvalued. Still not there yet.