The 70:30 Asset Allocation

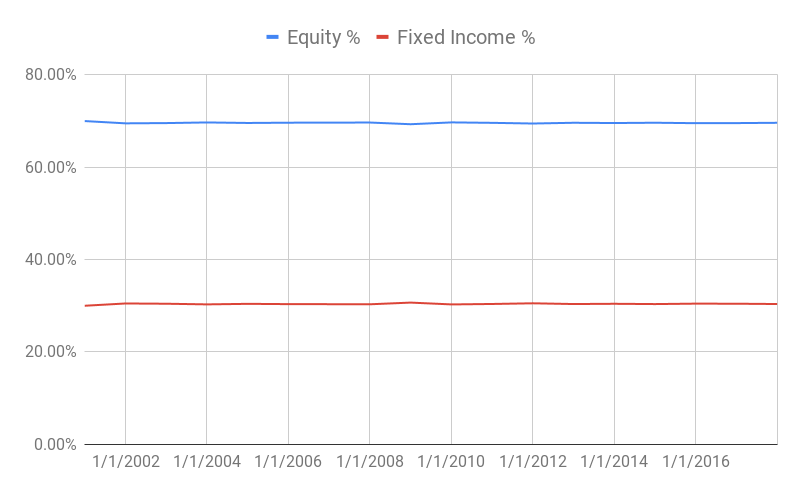

In my previous post, I talked about about allocating 70% to equity and 30% to fixed income and just keep that ratio irrespective of which stage you are in your life. But does it really work? Lets work out some examples to see how it might work under various conditions.

Pre-retirement

While you are still not retired, you have income coming in and you are investing. It does not matter what markets are doing, your job is to just invest in such a way that you maintain the 70:30 split.

The way it would work is that every month you will take stock of your equity and fixed income amounts. If the ratio of equity to fixed income is not 70:30, then invest in such a way that the investment in the asset class that is lower gets more investment and the other class gets less. For example if the ratio is 75:25 for a month, then invest more of your savings into fixed income and less or 0 in equity asset. Keep doing it until the ratio goes back to 70:30.

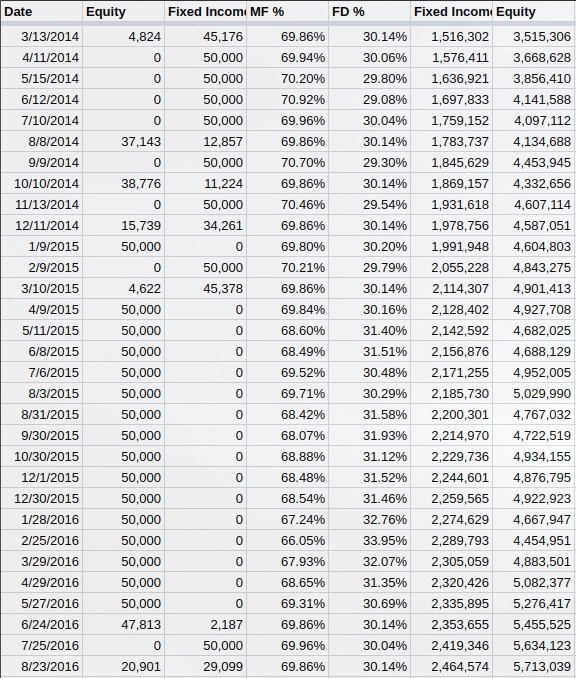

As an example, I have run the numbers for the last 10 years assuming that you will be investing in an equity mutual fund (that tracks nifty) and some fixed income asset class like an ultra short-term debt mutual fund that gives 8% returns. Your investment of Rs. 50,000 per month over 10 years would have become Rs. 1.03 crores if you just followed the 70:30 rule blindly! The data is calculated using historical data of Nifty from Jan 2008 to Dec 2017.

An example investment is shown below. For the full data, check out the Google sheet. Note how that in some months the investment in equity or fixed income is 0 because we want to bring the ratio back to 70:30 split.

Post Retirement

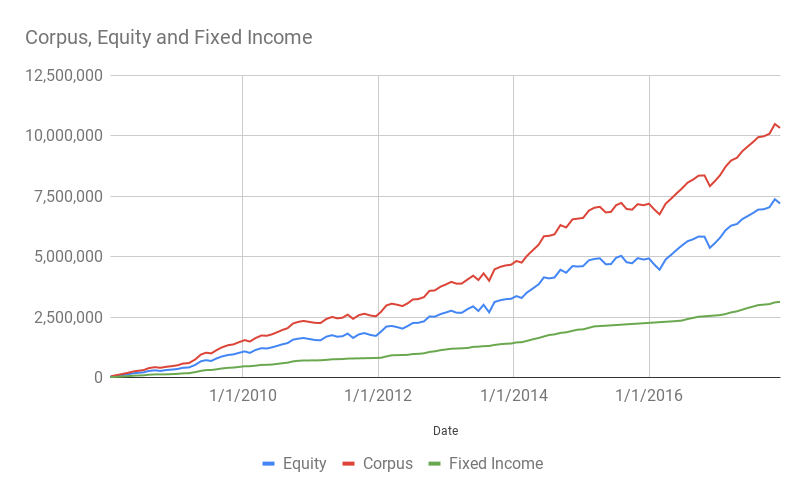

Lets do the experiment again assuming that you have retired in 2001. Since I have Nifty data only from 2001, I will run the experiment for the years from 2001 to 2018. How will your 17 years of retirement be funded by following the 70:30 split?

Say you start your retirement on Jan 1, 2001 with a corpus of Rs. 1 crore. Assume your expenses are Rs. 50,000 per month or Rs. 6 lakhs per year. Lets say your expenses increase by 8% every year. Further, lets assume your fixed income returns are 6% (conservative number, you can usually do better than that). If you follow the 70:30 rule, you will start with Rs. 70 lakhs in equity and Rs. 30 lakhs in fixed income asset classes.

Now, to fund your expenses, just sell Rs. 50,000 every month from fixed income. By the end of 1 year your fixed income would have gone down so your 70:30 ratio will have changed. Moreover, since equity markets are volatile, the equity ratio might go up or down. So we need to re-balance, either sell equity and buy fixed income or vice versa to maintain the 70:30 split. We re-balance only once a year at the start of the year. If we did this for 17 years, how would our corpus look like? Check out the chart below for the answer.

Did you notice from the graph above, how your Rs. 1 crore has become almost Rs. 3 crore after 17 years even as you are selling fixed income to fund your expenses and your expenses have been increases year over year? For the raw data, check out the Google spreadsheet. I generated the data using historical Nifty data from 2001 to 2018. During all those years you would have maintained a 70:30 split.

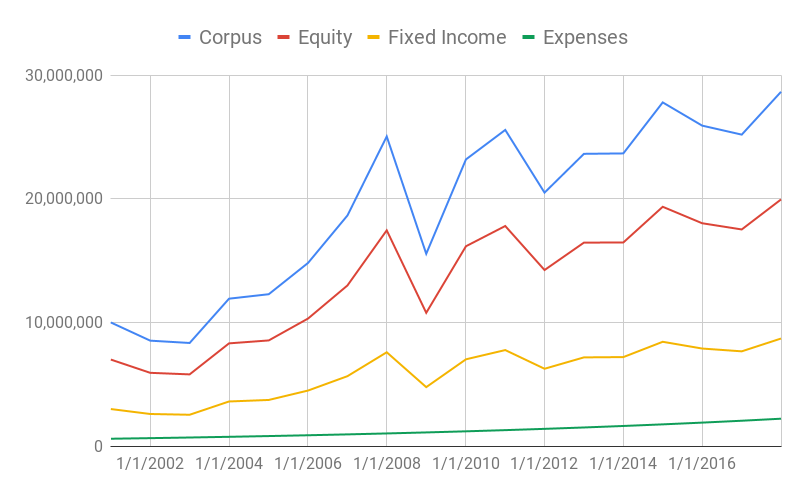

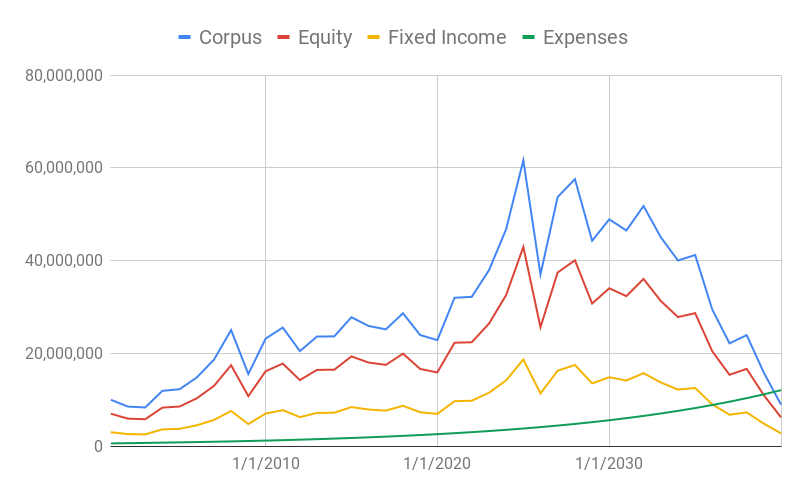

Just for fun, I interpolated the 17 years up to 40 years. Note that markets may not behave like in the past, but hypothetically if they were to behave the same as the past, then the 40 years of your corpus and expenses would look like this.

So seems like you could survive for 40 years post retirement, with Rs. 1 crore, with annual expenses of Rs. 6 lakhs, which increases by 8%, without any other income, if you follow the 70:30 rule. I would be happy with that kind of returns. Hopefully this gives you some understanding of how the 70:30 rule still works pre and post retirement. Obviously, for a Rs. 6 lakhs expense per year, you need Rs. 1.5 crore (see How Much Do You Need To Retire Calculator) and you probably can expect better returns and lower inflation than what is assumed here. What do you think? Leave your comments!